On Bitstamp, data from TradingView and Cointelegraph Markets Pro indicated daily highs of $62,323.

Although the number of initial jobless claims was lower than anticipated, the U.S. unemployment statistics did not cause the cryptocurrency markets to become more concerned about the direction of inflation.

As of this writing, BTC/USD was up 2.3% on the day. Traders were hoping that this trajectory may continue to push ask liquidity over the current price.

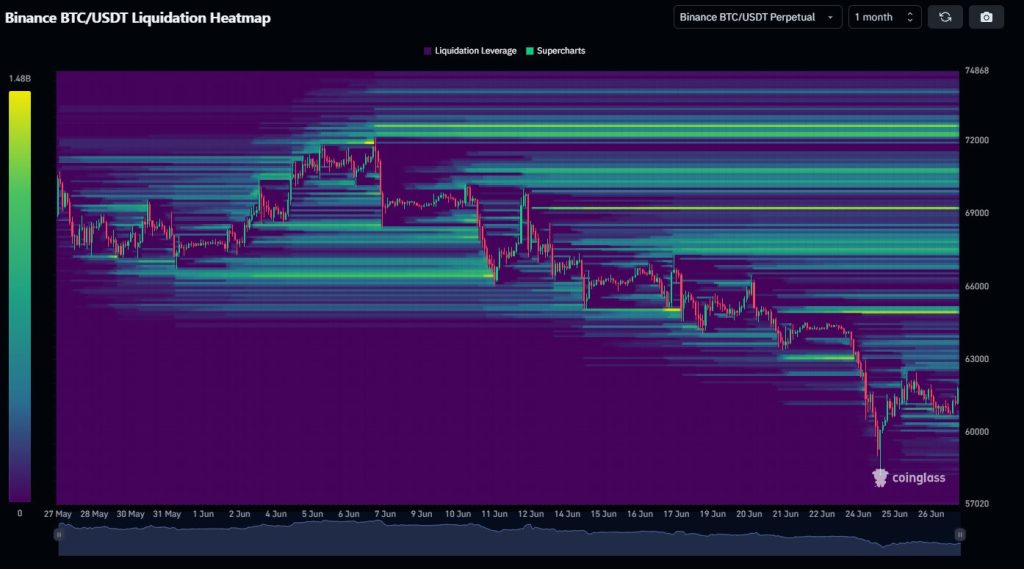

Popular trader Daan Crypto Trades stated in part of an update on X, “Most of the liquidity lies above after testing the range lows at ~$59K and taking all the liquidity that sat there.”

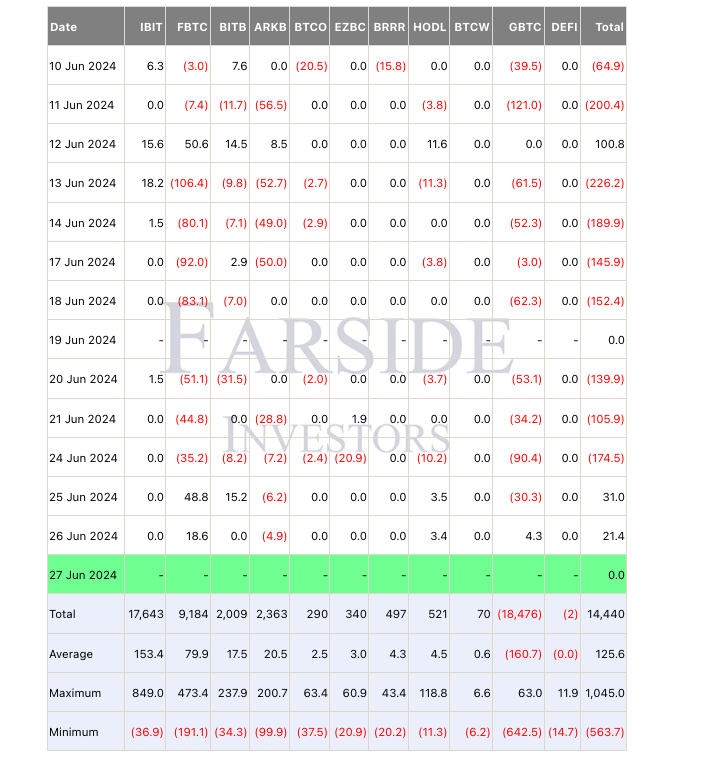

An accompanying chart showed BTC/USDT perpetual swap order book liquidity levels on the largest global exchange, Binance. Fellow trader Jelle added that the sell pressure narrative originating from both the U.S. and German governments in recent weeks had not made itself felt on the market. “Looks like Bitcoin’s range lows are holding – despite the US & German governments selling coins & Mt. Gox finally paying back creditors,” he suggested. Daan Crypto Trades acknowledged another encouraging sign in the form of a second consecutive day of net inflows to the U.S. spot Bitcoin exchange-traded funds (ETFs). These managed $21.4 million on June 26, following $31 million the day prior, data from sources including United Kingdom-based investment firm Farside Investors confirmed.

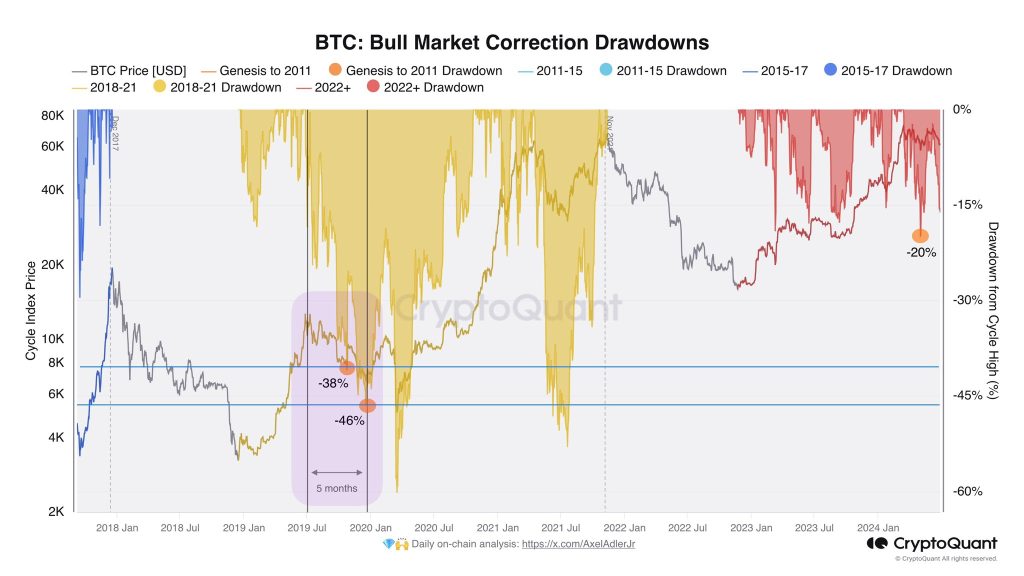

BTC price drawdown could last five months

He contended that Bitcoin was imitating behavior last observed around the end of 2019 by comparing recent price action with historical data.

In an X remark that day, he stated, “The current market closely resembles the 2019–20 correction, making it the most likely scenario for this correction, which lasted 5 months with a maximum drawdown of -46%.”