TradFi upheaval “cannot be ruled out”

“There’s a good chance that significant corrections in the financial markets will occur before the year ends, even if they don’t necessarily result in a major crisis,” economist Paolo Tasca, who founded the University College London Center for Blockchain Technologies, tells Magazine.

The starting point? Perhaps a pullback in AI stocks, but debt is, in Tasca’s perspective, the primary market to watch. Interest rate reductions may not be possible given the enormous budget deficits the US has been running. As a result, the bond and equities markets may “suffer from the continued restrictive monetary policy.”

Yu Xiong, a professor and director of the Surrey Academy for Blockchain and Metaverse Applications at the Surrey Business School, says that other possible catalysts include ongoing inflation, geopolitical unrest, and “the speculative nature of certain asset bubbles, including those in the tech and AI sectors.” “A global financial crisis in 2024 cannot be ruled out,” Xiong tells Magazine.

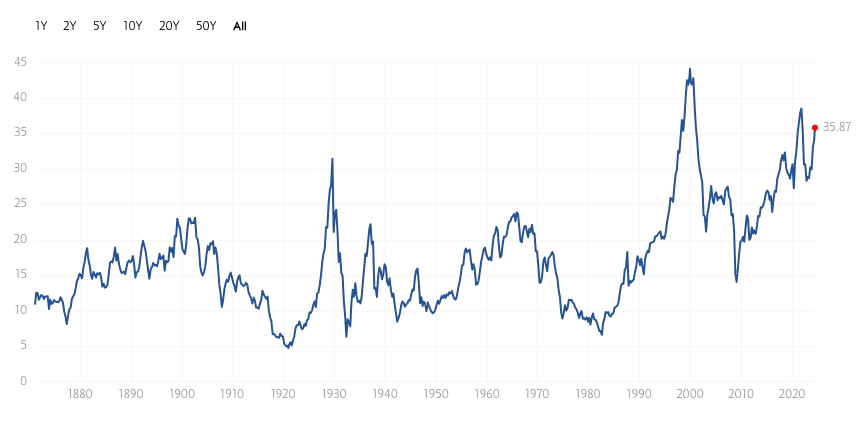

In other words, the Shiller ratio, which was more than double its historical mean on June 17 at 35.64, indicates that global equity prices are still high.

“With the exception of AI, equity markets, especially in the IT and growth sectors, are already expensive. “A correction might lead to more widespread market instability,” asserts deVere Group CEO and founder Nigel Green.

In addition, Green warns Magazine that “ongoing conflicts, like Gaza-Israel, or heightening geopolitical tensions, like the Taiwan issue, could lead to economic disruptions and investor uncertainty.”

Seek refuge in decentralized assets

What then can be anticipated in terms of cryptocurrency if the world economy as a whole collapses?

According to Xiong, “all assets, including cryptocurrencies, see a sell-off during the onset of financial crises as investors seek liquidity.” Prices in the cryptocurrency sector may collapse along with everything else.

However, he goes on, there may be a “recovery phase where investors seek refuge in decentralized assets, potentially reigniting the crypto bull run” in the middle term once the first panic passes.

Longer term, though, blockchain-based solutions should win out because of their advantages: “With AI’s rapid advancement, more people will advocate for the use of blockchain and other decentralized technologies, which will empower individuals.”

Is Bitcoin Safe from danger?

Yield App’s chief investment officer, Lucas Kiely, tells Magazine that “in the event of a sell-off, crypto would join TradFi assets in a sharp decline as these are bundled together in the initial shock.” However, given its “flight to quality” characteristic in comparison to other crypto assets, Bitcoin might recover more quickly.

Marc Fleury, CEO and co-founder of Two Prime, a financial technology company that focuses on the financial application of cryptocurrencies to the real economy, tells Magazine that while cryptocurrencies may not have fully separated from or turned anti-cyclic with the rest of the risk-on category, they have demonstrated in previous cycles that they can occasionally act as a safe haven.